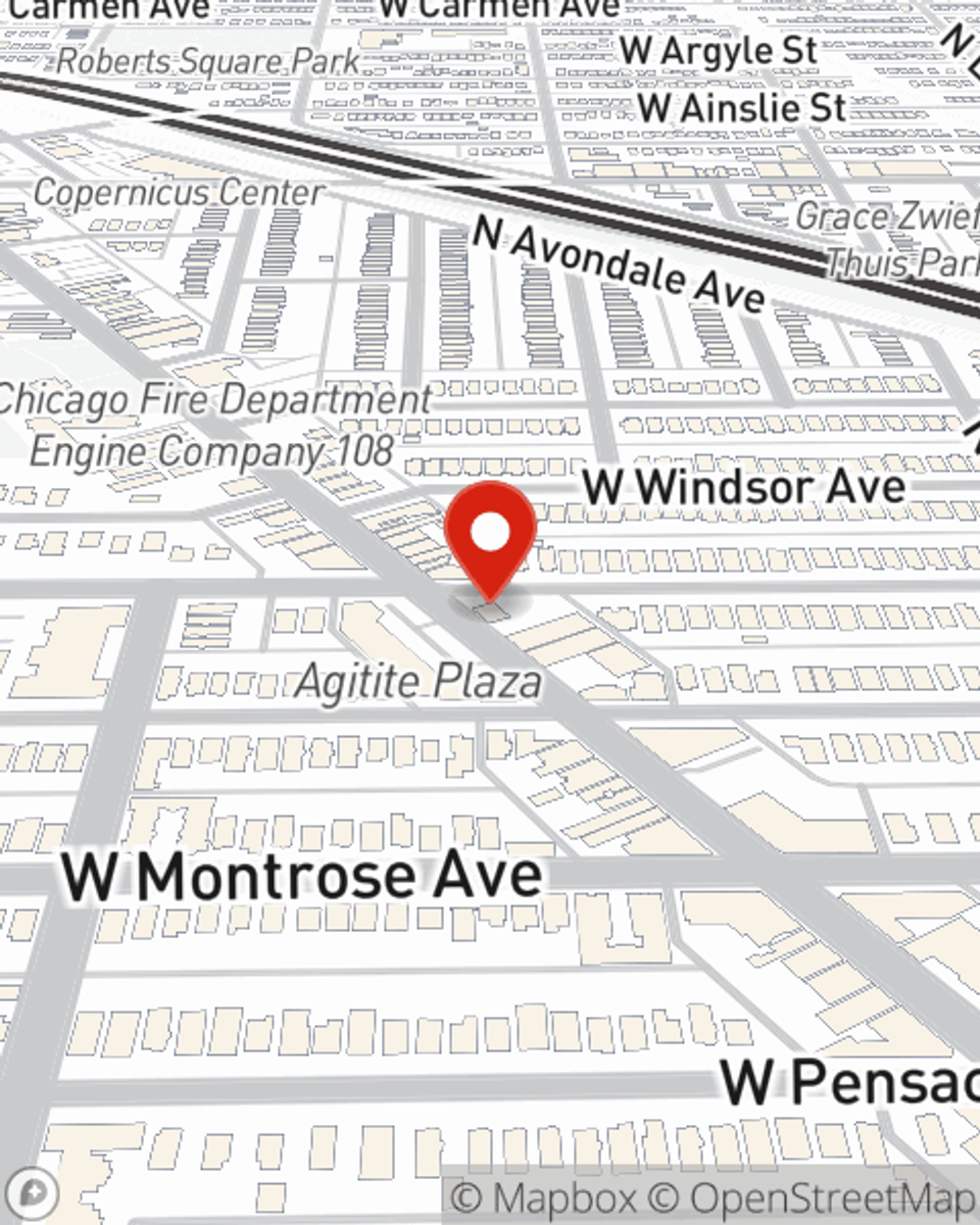

Business Insurance in and around Chicago

Chicago! Look no further for small business insurance.

Almost 100 years of helping small businesses

- Jefferson Park

- Portage Park

- Norwood Park

- Belmont Cragin

- Albany Park

- Logan Square

- Belmont Gardens

- Old Irving Park

- Hermosa

- Forest Glen

- North Park

- Lincoln Square

- Dunning

- Franklin Park

- Harwood Heights

- Park Ridge

- Elmwood Park

- River Forest

- Wicker Park

- Oriole Park

- Montclair

- River Grove

- Horner Park

- Bucktown

Your Search For Fantastic Small Business Insurance Ends Now.

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a HVAC company, a home improvement store, a photography business, or other.

Chicago! Look no further for small business insurance.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

When one is as passionate about their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for worker’s compensation, business owners policies, commercial liability umbrella policies, and more.

The right coverages can help keep your business safe. Consider stopping by State Farm agent Jim Mays Jr's office today to learn about your options and get started!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Jim Mays Jr

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.